The month of May marked the limited opening of businesses and loosening of the restrictions of the Coronavirus lockdown. However, the limitations placed on real estate from late March through April were in place for most of May. Just recently, showings were increased from 2 people at a time (real estate broker +1) to 3 people at a time & the commercial market is opened up for business as it had been shut down during the same time.

Below we take a look at important metrics which measure the health of the market & look for any trends, so you are informed to make the best decisions.

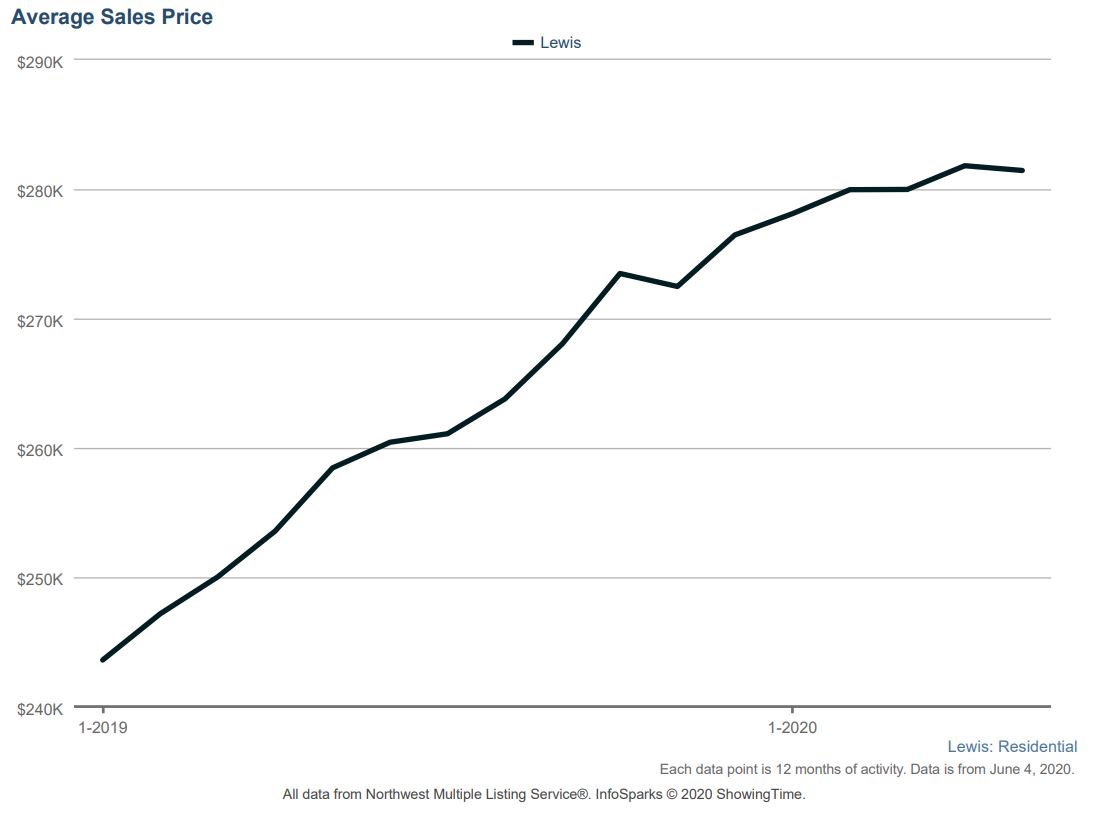

In the graph above, we take a look at average sales price. It went down about $400. These data points are averaged over 12 months of data so thought it might be a good idea to take a look at the monthly points to get an idea of what might be causing the decline.

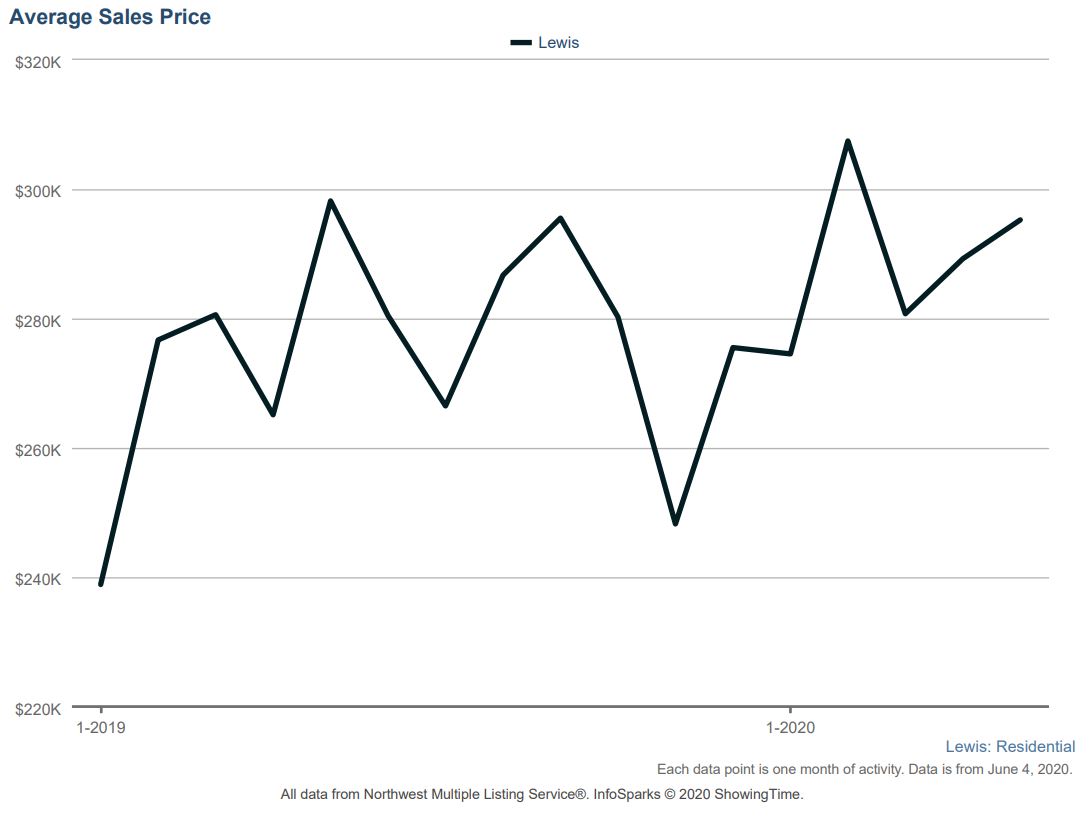

The graph above is the average sales price each month. As you can see it is up and down just about every month of 2019 as well as 2020, so not much change there. From February to March, there was a steep decline, but is trending upward from there so the previous graph is just showing the data points catching up from 2019’s decline around the same time. Overall, the market is still up almost 60K from January 2019 and about 20k from January 2020.

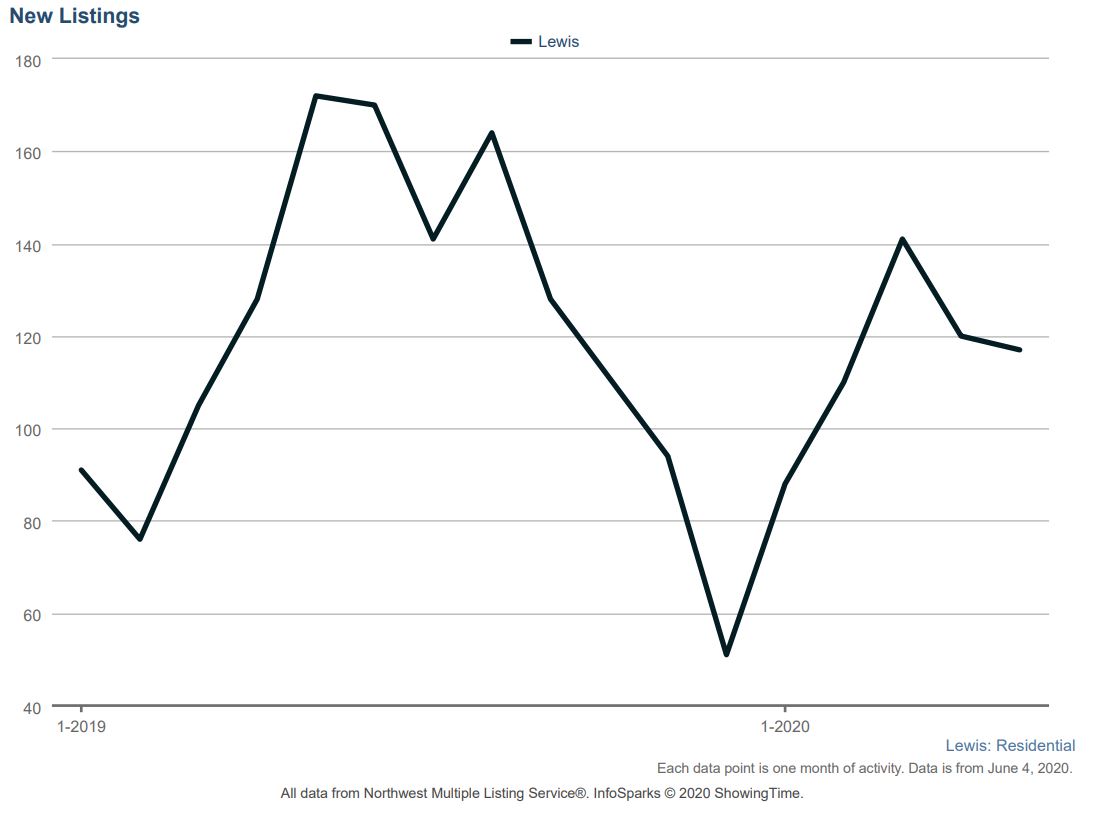

The graph above is showing new listings each month. As you can see, the peak of new listings occurred between March and May last year, and January through March this year. Many people think Summer is the time when most people move, but at least in the last few years, this has not been the case. We’re already low on inventory and it appears the Coronavirus cut short the peak listing season and each month new listings are harder and harder to come by!

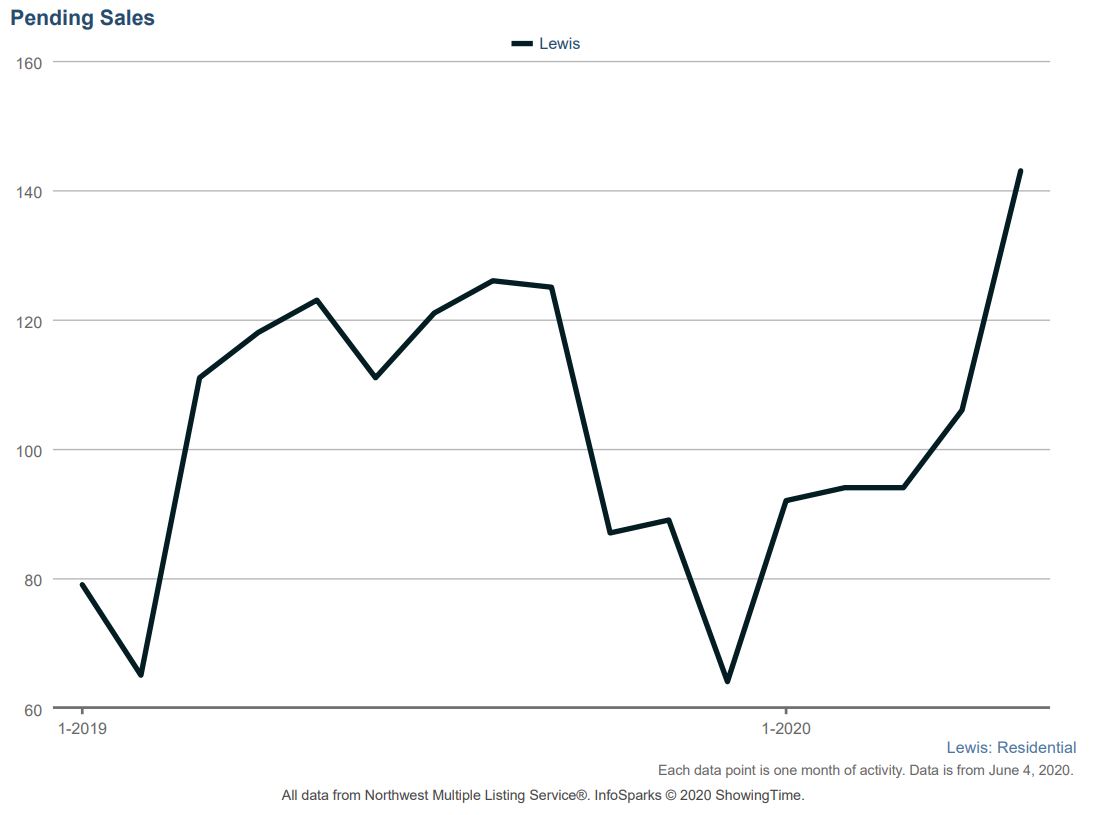

The graph above is showing pending sales. Compare this graph to the previous graph of new listings. Buyers are hungry for homes and the low inventory is funneling multiple buyers into the same homes. This is why we’re still seeing multiple offers and supports the record high growth in prices each month.

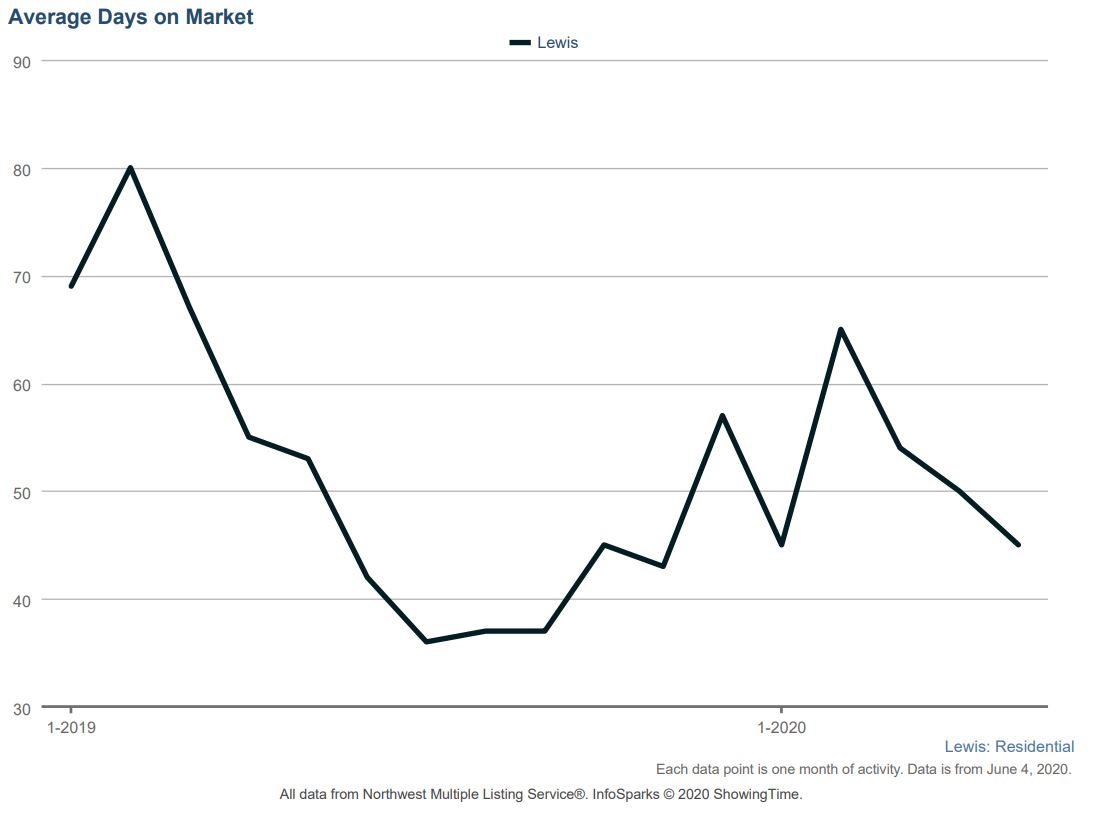

Finally, the graph above shows the average time a home is on the market. It is still around 45 days. You may be thinking it should be a shorter time frame, but we are seeing a lot of sellers pricing their home well above the market. This causes homes to sit until their price is reduced enough to get a buyer to take action. I ALWAYS recommend against this strategy because in the end, the home sits on the market longer AND the prices is almost always lower than the actual market value of the home. If you price it in line with the market, you’ll get multiple offers which drives the price up above the market. It may seem like a risky strategy but the approach is based on data driven analysis.

In these times of a changing and uncertain real estate market, you need a real estate broker you can trust to price your home accurately. If you’d like to find out the value of your most valuable asset, click here.