This is the 2nd part in the series of The Anatomy of the Deal where we’re breaking down the purchasing process into bite size pieces. In the first part of this series, we discussed the offer form. You can find that post at:

This week, we’re going to focus on another misunderstood and overly complicated subject: Financing

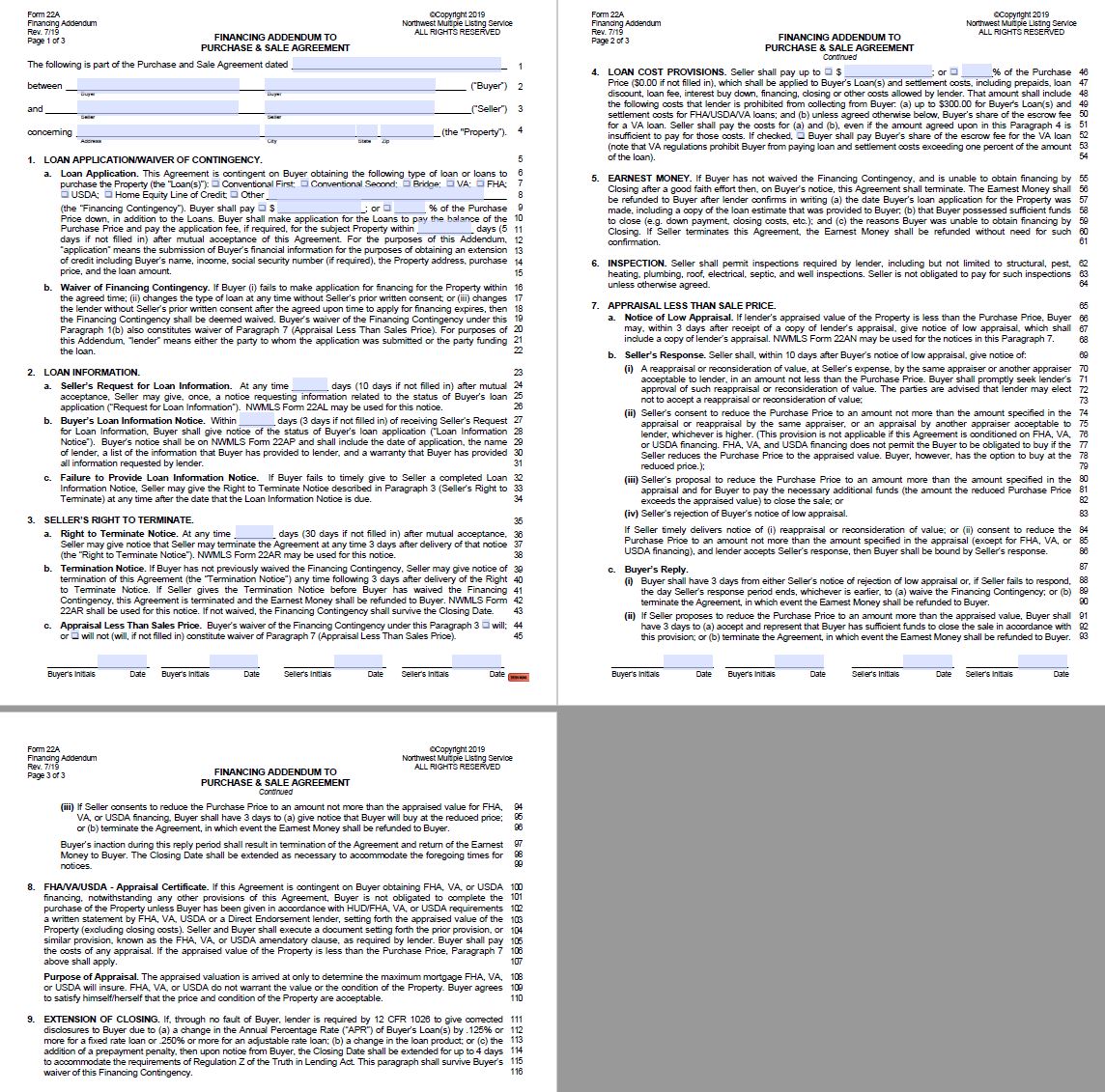

What you see above is the standard form used in a real estate purchase which outlines the financing contingency. Here, you will indicate what type of loan you will be using, how much money down you will do, & if you’re asking for any of your closing costs to be paid. There are other terms necessary to be explained during the purchase, but we’re keeping it simple to give you a broad overview.

Loan Type

This is the confusing part. You won’t know what loan you qualify for without speaking to a lender AND certain homes only qualify for certain loan types! This is where using a lender comes in handy. The difficult aspect to this is to understand that not all types of financing are equal. There are pros and cons to each financing type and it is up to you to decide what is best for your situation. This is also why Realtors will ask you for a pre-approval. Its not just about the amount! If you’re approved for a USDA loan it would not make sense to look at fixers, for example.

Down Payment

I, personally, never understood that there were multiple options for down payments before I became a Realtor. I always though it was 20%. This is NOWHERE NEAR the case! The majority of loans I see are between 0% – 5% down. This makes getting into your dream home a whole lot easier! Granted, 20% or more is best so you can avoid Private Mortgage Insurance (PMI) which will add approximately $167 (1%) to your monthly payment on a $200,000 loan.

Closing Costs

Did you know that seller can pay your closing costs? Did you know that you have closing costs?! Its true! The typical cost to close a loan for the buyer is $6,000+ added on top of your loan amount. This may or may not be typical in your area, and it is more likely to get seller to pay them if the house has been on the market a long time OR it’s a buyer’s market. The good news is, you don’t necessarily have to have the funds in your pocket – sometimes they can be wrapped into the cost of the loan or you can make a higher offer to have seller cover them. This is great information to know BEFORE you start making offers or even looking at homes.

As a Realtor, I work with many different lenders who can help your figure out your maximum buying power and determine with you the best loan for your situation. If you are considering making a move, this should be your first step. Feel free to reach out to me and let’s get the process started!